What's the State of Warehousing in Pennsylvania?

Warehouses have been growing tremendously over the past decade in Pennsylvania. In our recent report conducted with support from the Center for Rural Pennsylvania, we examined the impacts of warehouse development in Pennsylvania, focusing on rural areas. We studied three effects: economic impacts, transportation impacts, and community impacts over the ten-year period between 2014 and 2023.

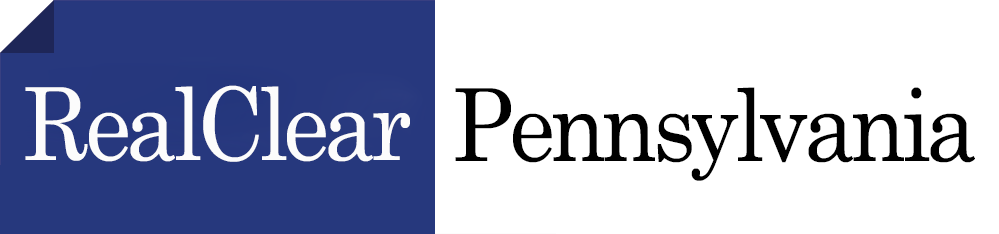

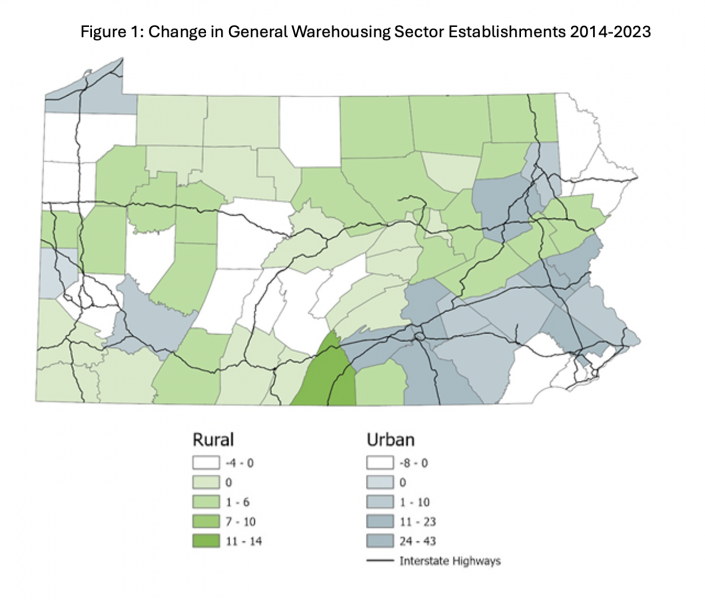

The key findings in our economic analysis included growth in the number of warehousing establishments in the General Warehousing sector, as identified through the Bureau of Labor Statistics Quarterly Census of Employment and Wages data (QCEW). This sector increased 35% between 2014 and 2023, from 693 to 939 establishments. In addition, the number of employees per establishment in the General Warehousing sector increased by more than 45% between 2014 and 2022. This points to not only the number but also the size of warehouses growing significantly. This growth is also reflected in the sector employment, which grew 91% during this time.

In addition to examining statewide trends, we also conducted an analysis on six case study counties that we identified as having experienced significant warehousing growth: Berks, Butler, Cumberland, Franklin, Lackawanna, and Schuylkill. These include rural counties (Butler, Franklin, and Schuylkill) and urban counties having a significant share of rural municipalities (Berks, Cumberland, and Lackawanna). Cumberland, Franklin and Berks counties’ warehousing growth has significantly outpaced that observed statewide. In these counties, the number of establishments increased by 50, 77, and 45%, respectively.

Our economic impact analysis, which relied on the IMPLAN input/output model, found that the average labor income for warehouse jobs in rural counties is higher than in urban counties, and that the share of total value added to the state’s economy by direct employment in the General Warehousing sector is much higher in rural counties compared to urban counties. Using data from the Pennsylvania Department of Community and Economic Development, we also assessed land value and tax revenue changes in municipalities in our case study counties with and without warehouse growth. We found that in all case study counties, the assessed value of land increased at a higher rate in municipalities with warehouses compared to those without them. When reviewing market value, we also found higher increases in warehouse municipalities in all our case study counties except Butler. Tax revenue impacts were more complex, with considerable growth observed in some warehouse municipalities, but not in others. Differences are likely due to the use of tax abatements for projects in some municipalities.

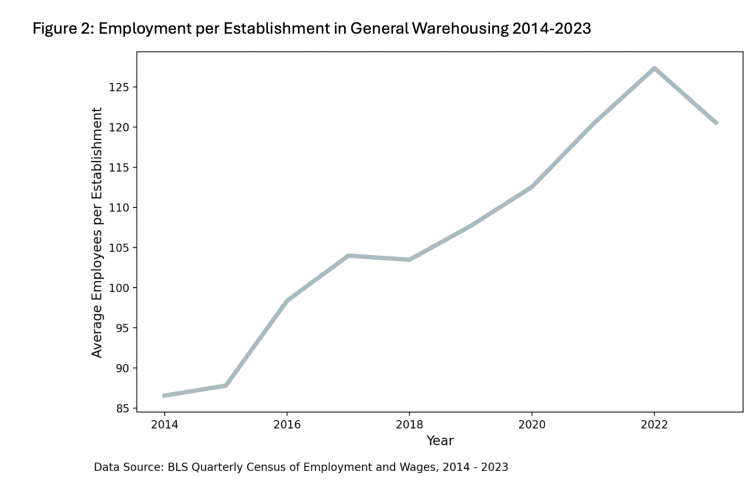

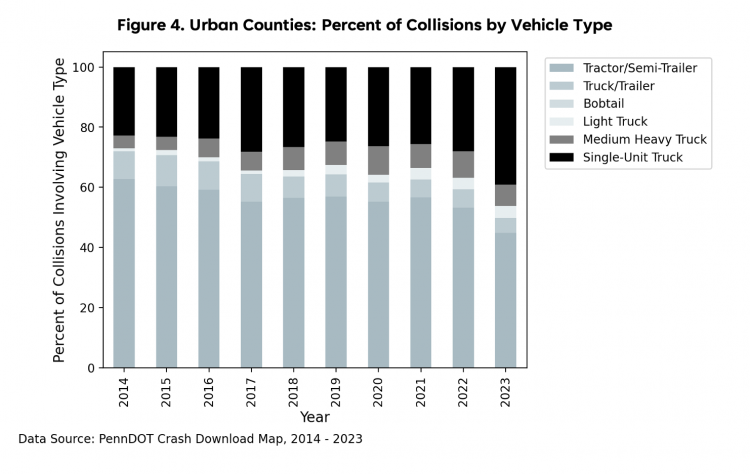

In order to understand traffic impacts of warehouses, we accessed collision data from PennDOT from the same time period. Collisions involving various types of e-commerce-related vehicles were selected for analysis. Overall, we found that collision rates remained relatively steady on state roads where warehouses tend to concentrate, but that more growth in collisions occurred on local roads, particularly on roads in proximity to warehouses or highway exit ramps. The type of vehicles that saw the most growth in accidents were single unit trucks, the vehicle types often used for last mile deliveries.

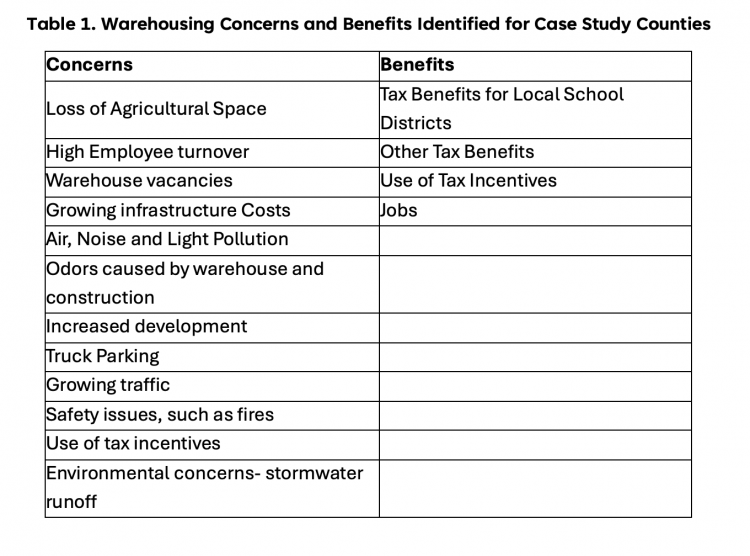

Since warehousing growth has many impacts on the surrounding community, we conducted a two-part analysis to identify the main concerns in our case study counties regarding warehouse development. We examined local newspapers in each county during the study time-period to find topics of concern covered locally. In addition, we conducted interviews of key stakeholders. The main results are highlighted in the table below, and include quality of life issues, economic, and transportation impacts.

Based on our analysis, we identified planning recommendations related to warehousing development, as well as identified areas of remaining research need. Some examples of planning recommendations include the need for cooperative warehouse and freight transportation planning between neighboring municipalities; the need for sharing of planning and management best practices across counties and municipalities; and the need to identify traffic mitigation strategies to manage safety impacts when warehouse access requires use of local roads. Examples of future research needs include further study of the specific job tradeoffs occurring between warehousing jobs and jobs in other sectors in rural areas of Pennsylvania; analysis of the short and long-term revenue impacts of tax abatements for warehouse projects; and identification of new data sources and data collection mechanisms to effectively capture warehouse project details, such as specific location, size, and facility construction and opening dates.

For more information, our report is available through the Center for Rural Pennsylvania.